The Senate’s most aggressive financial watchdog on Monday raised concerns from the left about the use of encryption,

Sen. Elizabeth Warren (D-Mass.) requested a meeting with federal regulators to discuss how a secure communications channel created by Symphony Communication, LLC could help financial elites dodge accountability.

In letters on Monday to the Departments of Justice, the Securities and Exchange Commission, and the Consumer Financial Protection Bureau and three other regulatory bodies, Warren asked “whether Symphony may make it easier for financial firms to evade the rules.”

She also asked if “Symphony’s ‘end to end encryption’ with ‘no backdoors’” and its “approach to permanent data deletion” impacted the regulators’ ability to access “compliance-related communications by financial firms?”

The New York State Department of Financial Services asked similar questions of Symphony in a letter to the company in July.

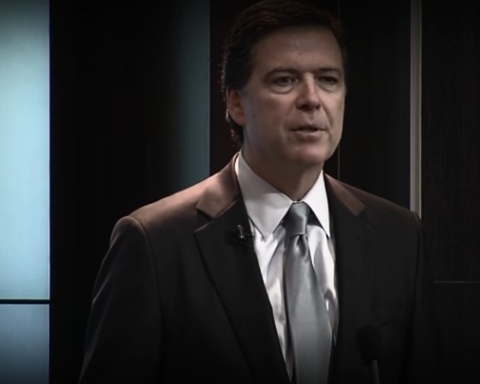

The inquiries mirror a debate occurring within the national security sphere over the use of cryptographic technology, where federal law enforcement figures have been pressing Congress for a “legislative fix” that would require companies to decrypt individuals’ data for the government.

FBI Director James Comey, however, has made little mention of banks using encrypted technology in his multiple warnings about tracking criminals who are, in his words, “going dark.”

In her letters, Warren referenced how during the 2012 LIBOR interest rate-fixing scandal, bankers “used chat rooms and text massages to coordinate their activities,” and that it was “the trail of such messages that permitted regulators both to discover and prosecute these financial crimes.”

“The communications that Symphony will allow companies to hide from ‘government spying’—such as text messages and chat room transcripts—have proven to be ‘key evidence’ in previous regulatory and compliance cases that have uncovered criminal action by Wall Street,” Warren noted.

Symphony, which received $66 million in funding last year from 14 Wall Street firms including Goldman Sachs, JP Morgan, and HSBC, offers financial sector clients “end-to-end encryption” with “no service-provider or vendor access to decrypted customer data.” It markets its service as being useful for “cross-organization communication.”

Following the release of a beta version last month, Symphony officially launched its “Enterprise edition” on August 3.

“We’ve created the only secure, cloud-based communications platform trusted by the world’s largest financial institutions,” the company boasted in a blog post announcing the release.